Will My Spouse Get My Pension in a Divorce? Understanding Virginia's Laws

- brookthibault

- Nov 17, 2025

- 5 min read

If you're facing divorce in Virginia and wondering about your pension, you're asking one of the most important financial questions of your life. The direct answer is: your spouse may be entitled to a portion of your pension, but only the part you earned during your marriage: and never more than 50% of that marital portion.

Understanding Virginia's pension division laws can help you protect your retirement security while ensuring a fair outcome for both parties. Let's break down exactly how this works and what you can do to safeguard your financial future.

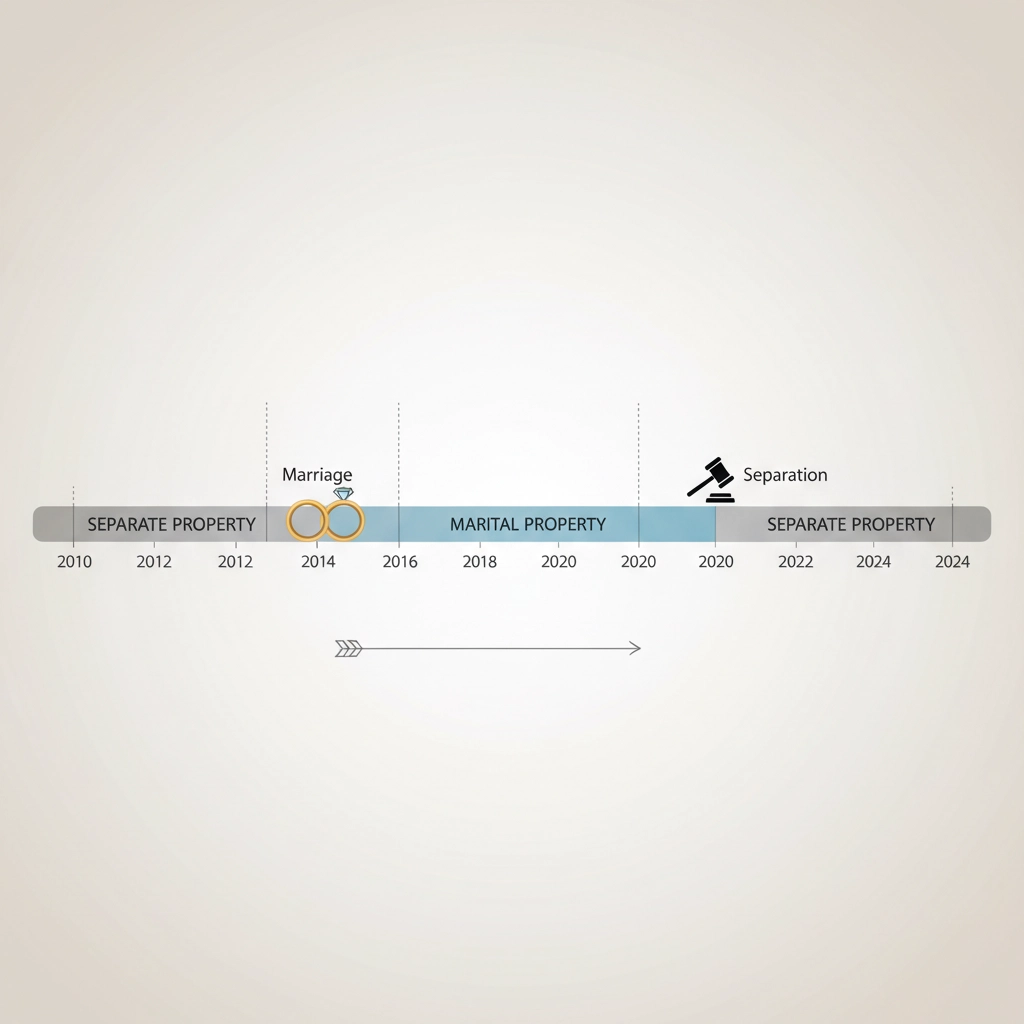

The Foundation: Marital vs. Separate Property

Virginia courts operate under a fundamental principle: they can only divide marital property, not your separate property. When it comes to your pension, this distinction becomes critically important.

Your pension contributions and benefits fall into two categories:

Separate property: Pension earned before your marriage or after your legal separation

Marital property: Pension earned during your marriage

Think of it this way: if you worked for 30 years but were married for only 15 of those years, only those 15 years of pension contributions are considered marital property. The remaining 15 years of benefits remain yours alone, regardless of your spouse's contributions to the household or marriage.

This temporal approach means the timing of when you earned your pension matters more than whose name appears on the account or who worked to earn it.

Virginia's 50% Maximum Rule: Your Built-in Protection

Virginia law provides a crucial safeguard: your spouse cannot receive more than 50% of the marital portion of your pension, period. This ceiling applies regardless of:

The length of your marriage

Your spouse's financial situation

Other assets in the divorce

The type of pension (military, federal, private, union)

However, it's important to understand that this is a maximum, not a guarantee. Since Virginia follows equitable distribution rather than community property laws, judges consider multiple factors when dividing assets:

Each spouse's earning capacity

Contributions to the marriage (both financial and non-financial)

Age and health of both parties

Debts and other assets

Standard of living during the marriage

In practice, most pension divisions hover around the 50% mark for the marital portion, but judges have discretion to order different splits based on your unique circumstances.

Understanding Different Types of Retirement Plans

Not all retirement benefits are created equal, and Virginia courts handle different types differently:

Defined Contribution Plans

These include 401(k)s, IRAs, 403(b)s, and similar accounts where you can see the exact account balance. Division is relatively straightforward:

Calculate contributions made during the marriage

Determine growth/earnings on those contributions

Award the non-employee spouse up to 50% of that marital portion

Defined Benefit Plans (Traditional Pensions)

These traditional employer pensions promise specific monthly payments at retirement. They're more complex because the future benefit amount depends on factors like:

Years of service

Salary history

Age at retirement

Plan-specific formulas

For these plans, courts typically use one of two approaches for division.

Two Methods for Dividing Your Pension

Present Value Method

An actuary calculates your pension's current worth, considering factors like your age, life expectancy, and expected retirement date. Your spouse receives their share immediately through other marital assets, and you keep the entire pension when you retire.

Advantages:

Clean break: no ongoing financial ties after divorce

You maintain full control of your retirement timing

Simpler long-term management

Disadvantages:

Requires other assets to "buy out" your spouse's share

Actuarial calculations may undervalue or overvalue the pension

You bear the investment risk if pension performs better than expected

"If, As and When" Method

Your spouse receives their share of pension payments only when you actually start receiving benefits. This approach defers the division until retirement.

Advantages:

No need for other assets to offset pension value

Both parties share investment and longevity risks

More accurate division based on actual benefits received

Disadvantages:

Ongoing financial connection with your ex-spouse

Your retirement timing affects your former spouse

Requires ongoing plan administration

Most couples choose the "if, as and when" method, especially when the pension represents a significant portion of marital assets and other property isn't sufficient for an immediate buyout.

The Legal Paperwork: QDROs and COAPs

To actually divide retirement benefits, you need specific court orders that comply with federal law:

Qualified Domestic Relations Orders (QDROs)

Most private, state, and local government pensions require a QDRO. This specialized court order:

Directs the plan administrator to pay benefits directly to your former spouse

Ensures compliance with federal ERISA regulations

Protects both parties' rights under the pension plan

Court Orders Acceptable for Processing (COAPs)

Federal pensions (like FERS, CSRS, or military retirement) use COAPs instead of QDROs. These orders serve the same function but must meet specific federal requirements.

Critical timing note: These orders must be entered before your divorce is finalized. If you forget this step, you may need to return to court later, potentially at significant additional cost.

Strategies to Protect Your Pension

While you cannot completely shield marital pension benefits from division, you have several options to minimize the impact:

Asset Trading

Consider offering your spouse other marital property in exchange for a larger share of your pension. For example:

Trade your pension share for the marital home

Exchange pension benefits for investment accounts

Offer increased alimony in lieu of pension division

Negotiated Agreements

Remember, the 50% maximum is a legal ceiling, not a requirement. If your spouse agrees, you can negotiate any division arrangement. Sometimes, a spouse might accept less than 50% in exchange for other considerations.

Timing Considerations

If you're close to retirement, consider whether accelerating your retirement timeline makes sense. Once you begin receiving benefits, the division calculations become more straightforward.

Professional Valuation

Invest in a qualified actuary or pension specialist to ensure accurate valuation. An undervalued pension could cost you thousands in unnecessary division, while an overvalued pension might lead to unfair asset trades.

Special Considerations for Common Pension Types

Military Retirement

Military pensions follow the same Virginia rules, but federal law adds extra protections. The Uniformed Services Former Spouses' Protection Act governs military pension division, and your ex-spouse must have been married to you for at least 10 years of your military service to receive direct payments.

Federal Employee Pensions (FERS/CSRS)

Federal pensions require COAPs and have specific rules about survivor benefits. The Thrift Savings Plan (TSP) portion follows different rules than the basic pension benefit.

State and Local Government Pensions

Virginia's state pension systems (VRS) and local government plans each have specific procedures, but all follow Virginia's equitable distribution and 50% maximum rules.

Taking Action: Your Next Steps

Understanding your rights is the first step toward protecting your financial future. Here's what you should do:

Gather documentation of all pension benefits, including statements, plan summaries, and beneficiary information

Calculate the marital portion by identifying exactly when you earned each benefit

Consider your options for division methods and potential asset trades

Consult with experienced counsel who understands both Virginia law and federal pension regulations

Pension division involves complex legal and financial considerations that can significantly impact your retirement security. The decisions you make during divorce will affect your financial well-being for decades to come.

Don't navigate this critical process alone. An experienced Virginia divorce attorney can help you understand your options, protect your interests, and ensure compliance with all legal requirements. Your future financial security depends on the decisions you make today: make sure they're informed ones.

Ready to protect your pension and secure your financial future? Contact our experienced Virginia divorce team for a confidential consultation about your specific situation.

Comments